tucson sales tax rate change

Simplify Arizona sales tax compliance. TAX RATE CHANGES EFFECTIVE FEBRUARY 1 2018.

Tax Legislation For 2022 Arkansas House Of Representatives

As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No.

. You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables. If you do not separately itemize the tax you may factor. The City of Tucson is asking voters to extend the existing temporary half-cent sales tax for an additional 10 years.

Vehicle purchases can be made at Jim Click Ford in Sahuarita Oracle Ford in Pinal County in Nogales and of course. Groceries are exempt from the Tucson and Arizona state sales taxes. As UA is exempt from the collection of City of Tucson sales tax for sales made by the UA this change will only apply to purchases from Tucson vendors located within the city limits.

Effective July 01 2003 the tax rate increased to 600. If you itemize tax separately on your customers receipts and keep records of it on your books you may take the actual tax collected as a deduction. Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement.

As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No. Retail Sales 017 to five percent 50 Communications 005 to five and one-half percent 55 and Utilities 004 to five and one-half percent 55. This change has no impact on Arizona use.

This change has no impact on Arizona use tax assessment which remains at 56. Tusayan AZ Sales Tax Rate. Effective July 01 2009 the per room per night surcharge will be 2.

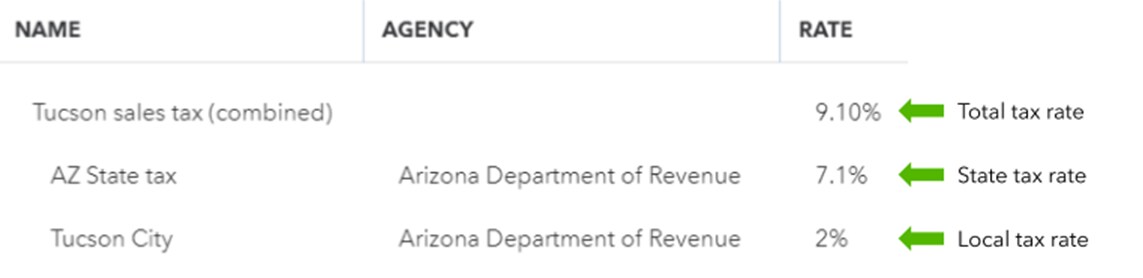

We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. As of March 1 2018 the local tax rate in Tucson is 26 on the following business classifications. Tucson sales tax rate change Monday February 14 2022 Edit.

Vail az sales tax rate. The current total local sales tax rate in Tucson AZ is 8700. The City of Tucson is asking voters to consider a half-cent sales tax increase over the next five years.

19-01 to increase the following tax rates. The funds collected through the half-cent sales tax over the 10-year period will be used solely for neighborhood street improvements and systemwide street safety projects. Tucson Estates AZ Sales Tax Rate.

Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. A yes vote supports extending an existing additional sales tax of 05 for 10 years with revenue dedicated to residential street repairs thereby maintaining the total sales tax rate in Tucson at 87. Tucson Proposition 411 is on the ballot as a referral in Tucson on May 17 2022.

This is the total of state county and city sales tax rates. SE FWD change trim Avg. Amusements Commercial rental leasing and licensing for use.

4 rows The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County. The Arizona state sales tax rate is 56 and the. But big ticket items such as cars and appliances can easily be purchased elsewhere and often at significant savings over purchasing within City limits.

Arizona Sales Tax Rates By City County 2022 State And Local Sales Taxes In 2012 Tax Foundation Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia. On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. Parker Salome Ehrenberg Bouse Wenden and Cibola.

On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No. Lowered from 76 to 66. The City of Tucson receives 2 tax from all taxable sales by businesses located within the city limits regardless of the customers location.

Az sales tax rate. The following are the tax rate changes. Tumacacori AZ Sales Tax Rate.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. The county sales tax rate is. Accordingly effective february 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in tucson.

Effective July 01 2016 the per room per night surcharge will be 4. Tucson Sales Tax Rates for 2022. 11518 to authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement Fund.

Tucson AZ Sales Tax Rate. Tubac AZ Sales Tax Rate. The funds collected over the five-year period would be split with 100 million being used to restore repair and resurface City streets and 150 million would be spent on vehicles equipment and facilities for the Tucson Police Department and Tucson Fire.

19-01 to increase the following tax rates. Tumacacori-Carmen AZ Sales Tax Rate. The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson.

This extension will not increase the Citys current sales tax rate of 26. Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87. Effective July 1 2017 the rate will rise from 20 to 25 increasing the total retail sales tax rate in Tucson AZ from 81 to 86.

Choose Avalara sales tax rate tables by state or look up individual rates by address. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53.

Tucson AZ Sales Tax Rate. This change has an effective date of October 1 2019. The December 2020 total local sales tax rate was also 8700.

A no vote opposes extending an existing. Tucsons sales tax rate is 26 which is over 1000 on a typical new car. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3.

Gross Receipts Location Code And Tax Rate Map Governments

State And Local Taxes In Arizona Lexology

2021 Arizona Car Sales Tax Calculator Valley Chevy

State And Local Sales Taxes In 2012 Tax Foundation

Important Tax Changes For Individuals And Businesses Every Year It S A Sure Bet That There Will Be Change Accounting Services Receipt Organization Accounting

Pin By Michelle Thomas On Salesforce Checklist Salesforce Property Tax

The Further Consolidated Appropriations Act 2020 Signed Into Law On December 20 2019 Extended A Number Of Expir Accounting Services Accounting Firms Tucson

Property Taxes In Arizona Lexology

Arizona Sales Tax Rates By City County 2022

New Homes For Sale In Chino California Quick Close In Chino With A 3 Broker Fee Broker S Welcome Spanish Farmhouse New Homes For Sale New Home Builders

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Pin By Linnell King Edwards On Andy Braun Loan Officer Flyers Home Buying Finance Plan Paying Off Mortgage Faster

How To Calculate Sales Tax Video Lesson Transcript Study Com

Sales Tax Rates In Major Cities Tax Data Tax Foundation